by Nikolay Vanyov

The effects of Russia's unjustified aggression in Ukraine on the economies of Bulgaria and developed countries globally have been considered frequently, with rising inflation and the fight against it being addressed repeatedly. However, the emerging global markets of the BRICS countries (Brazil, Russia, India, China, and South Africa) remain on the periphery.

Politically, these countries try to maintain a balanced position in the conflict to some extent (India, Brazil) or even declare some support for Russia (China's 'borderless' friendship). Their non-inclusion in the sanctions imposed against Russia is a topic of broad political discourse that certainly does not put them on the right moral side, but what are the effects on their economies and development in this one year of Russian folly in Ukraine?

Let's examine this question through the lens of economic data in 4 major emerging markets - Brazil, India, China, and Mexico, focusing on key macroeconomic indicators, sovereign debt market data, and stock market data over the year since the start of Russian aggression in Ukraine. To this end, we will compare key indicators in these countries with those in Germany, the United States, and Bulgaria to make the comparison complete.

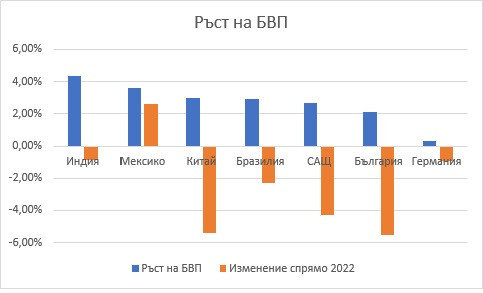

GDP growth Since inflation was and still is the dominant theme of the global economy, the possibility of a recession following measures to tame it is becoming an increasingly central point. It seems, for now, much more distant for the BRICS countries than for the US and Germany

For 2022, India remains the leader in GDP growth, which stands at 4.36% YoY, and the BRICS countries are seriously outpacing those of the EU. At the same time, almost all countries are seeing a decline in GDP growth, except for Mexico, where the Obrador administration's serious bids to fight organized crime are improving the Latin American economy. At the same time, Chinese growth fell by as much as 5.40% over the year, but this was largely conditioned by the Zero-COVID policy maintained for most of it, severely limiting the outlook for the Chinese economy.

The outlook for developed countries in 2023 points to a recession, but it is still possible to avoid it. At the same time, the Chinese economy is expected to return to a growth path of around 5% in 2023. For Europe, the outlook is far bleaker, with a recession in Germany looking very likely. In general, the structural problems of European economies, much more heavily tied to Russian energy sources than other countries, and the lack of any real means of fighting inflation by the ECB that would not severely jeopardize economic development, both of the currency union and of the continent as a whole, are having their negative impact on economic growth.

Unfortunately, Bulgaria also lost a lot in 2022 in terms of economic growth, but on the other hand, it seems far less threatened by the recession than the major European economies.

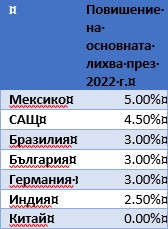

Inflation and monetary policy The main conclusion here seems to be that the price shocks that have been seriously felt in developed countries have not been such a problem for the BRICS countries. Graphically, it looks like this:

Chart 2 shows the effect of inflation and the key interest rates set by central banks to combat it. Significantly, the BRICS countries are positioning their key interest rate above the inflation rate, which in turn is leading to very little inflationary growth, and the differences with Germany are very telling.

As for the aggressiveness of central banks in the fight against inflation, the wait-and-see stance taken at the end of 2021 has certainly not paid off for the ECB and the Federal Reserve, while the institutions of the BRICS countries acted significantly earlier and more aggressively..

The exception here appears to be China, where the People's Bank has continued the policy of monetary stimulus to support the Zero Covid strategy. Overall, the Covid restrictions in the Celestial Empire had their impact in keeping inflation low during the year.

The data suggest that the BRICS countries appear better equipped to fight inflation than the advanced economies, with their stance towards sanctions on Russia having little bearing on this, with high interest rates and aggressive central bank policy being the main contributors. The commentary on Bulgaria's position, especially as regards the rampant inflation in our country, is mostly related to the total lack of political resolve and the application of only fiscal measures to cushion inflation, which have real repercussions in pro-inflationary impacts, with the data showing the country's serious underperformance in both developed and emerging markets.

Currencies The national currencies of emerging economies have generally shown a tendency to retreat against the US dollar in periods of high turbulence and uncertainty, as 2022 certainly was Their declines during the year were a fact of life:

National currency appreciation/depreciation against the dollar in 2022

The exception was again the Mexican peso, at its highest level against the greenback since 2017, mainly due to the central bank's highly aggressive actions, expressed in an increase in key interest rates. The effect is similar for the Chinese yuan but with the opposite sign.

Overall, the currencies of the BRICS countries outperformed the euro against the greenback in 2022, the effects are mainly related to central bank actions rather than the results of specific policies.

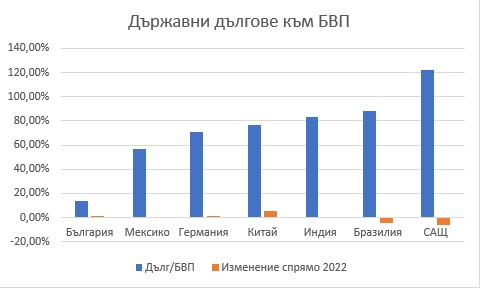

Sovereign debt There are two main aspects to considering sovereign debt: indebtedness and yields on underlying sovereign debt.

As far as sovereign debts are concerned, despite the measures implemented by almost all countries to mitigate the effects of inflation, mostly related to the increase in fiscal spending, the explosion of indebtedness has not happened:

Debt to GDP ratio

The absence of this explosion is mainly due to the strong nominal GDP growth of the countries, which mitigated the increase in the relative level of debt to the economies of the countries. Developing economies remain at stable debt levels of 55%-85% of GDP.

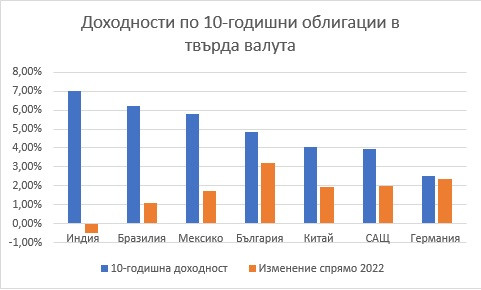

That was not the case for countries' key hard currency yields

Given the rise in key interest rates and inflation, sovereign yields took off, with the most significant increases in the US and Germany and advanced economies. The interruption of the low-interest rate cycle was expected yet painful for debt markets.

In yields, the big surprise was the serious rise in Bulgarian yields over the year, despite the country's extremely low indebtedness. It should be noted that the increase in domestic yields was commensurate with those of the countries in the region, and yet poor debt management and extremely inconsistent debt policies led to this increase, which put us on a par with the BRICS countries.

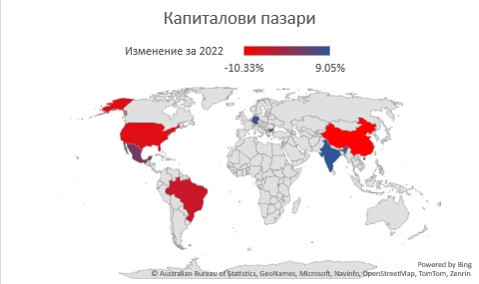

Capital markets The impact of the war on the capital markets of developed and developing countries was mixed, with no clear trends. There were declines in the US and deeper declines in China, while German equities, especially those in India, rose. Driving these divergent developments were domestic reactions to heightened global uncertainty.