Dr. Boyan Ivanchev

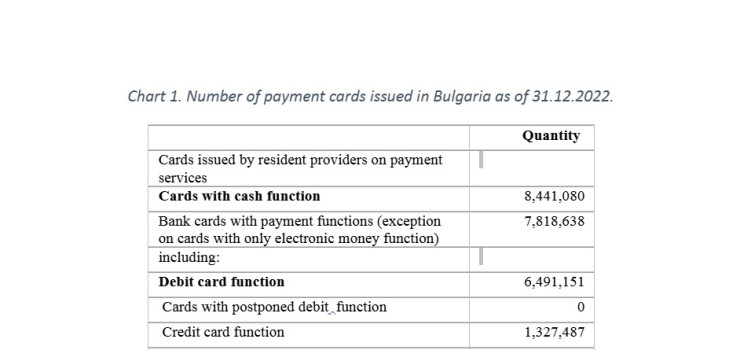

ECB statistics show that credit/debit card payments in the EU per capita increased from 108.2 in 2017 to 166.4 in 2021. Over the same period in Bulgaria, the number of credit/debit card payments per capita increased from 18.3 to 41.4 or 2.3 times. Bank cards issued in Bulgaria are becoming increasingly popular and ubiquitous.

- In 2022, the total number of cashless payments in the euro area increased by 12.5% to 114.2 billion, and their total value increased by 18.6% to €197 trillion.

- Card payments made up 49% of the total number of non-cash payments, while credit transfers accounted for 22% and direct debits – for 20%.

- The number of issued bank cards increased by 4.6% to 637.7 million, which represents about 1.9 payment cards per euro area resident

- Around 50 billion transactions processed by retail payment systems in the euro area, worth €41.1 trillion.

This trend will continue until cash is completely replaced by electronic and digital money. All this is happening due to the development of payment systems and the Internet of Things (IoT), due to legal requirements to limit cash payments, the reduction of the shadow economy, control over money laundering, operations related to terrorist and gangster organizations.

The use of card payments has a serious effect on increasing our irrationality. Behavioural economics and neuroeconomics prove that the behavioural model of paying in cash and with plastic money has different effects and consequences. There are many studies in this field that have scientific and practical evidential value. In one of these studies (Committing to Plastic: The Effect of Credit Cards on Purchase Intention), carried out by the economists Drazen Prelec and Duncan Simester of the Massachusetts Institute of Technology, randomly selected participants had to purchase tickets for the professional basketball league. Half of the participants had to pay cash for the tickets; the other half participants had to pay by credit card.

The results of the experiment showed that those who had to purchase tickets by credit card were willing to pay an average price that was more than twice as high as the price that participants were willing to pay cash. That is, credit card buyers were willing to pay over 100% more for tickets, due to the behavioural pattern that psychologically causes the credit card buyer to perceive the purchase as a type of deferred payment (at the end of the month or at the end of the credit card grace period) and, therefore, not immediately feel the psychological discomfort, as when letting this amount go when paying cash.

On this basis is built the leading hypothesis in the modern scientific literature that credit cards (and other similar tools) make shopping easier, by reducing the psychological pain of paying, which would otherwise hold back/reduce spending. This is due to the mechanism of psychological experience that card

transactions temporally separate the payment process from acquisition/consumption.

This psychological and mental separation of acquisition/consumption from payment occurs because the payment is delayed in time and/or can be repeatedly deferred (within an interest-free grace period or within a longer period where interest is also accrued to the card account) and in fact the actual repayment date is blurred and not exactly fixed. Additionally, the pending payment amount is ambiguous and questionable because we are paying off the total accumulated various credit card charges, which are combined into a total balance and payment amount.

This process of mental separation of the payment-consumption process makes people less cautious at the time of purchase, regarding the price of a good or service, and makes them tend to buy more often and pay a higher price with plastic money than in cash. Recent neuroeconomic research shows that brain activation for cash and credit card purchases is different when imaged by functional MRI in specific psychological paradigms/tasks.

Credit card purchases are associated with strong activation in the striatum and no activation induced by product price. Upon a cash purchase, brain activation of reward areas responded weakly and only to relatively cheaper items. In a 2021 paper by economists Sachin Banker, Derek Dunfield, Alex Huang and Drazen Prelec titled Neural Mechanisms of Credit Card Spending experimentally demonstrated that there are differences in the activation of brain reward areas and highlighted the potential for the neural impact of new payment instruments to stimulate/increase consumer spending.

At a lower level of reasoning, we can add the observation that almost entirely the word "buy" in advertisements has been replaced by "get." The aim is also to change the psychological experience and reduce the psychological pain of "buying" by disguising it as "getting". The word "take" neurolinguistically tells us “It’s free" and that something is taken in hand and consumed as if it were not paid for. The primitive desire to "take" without paying was already described by Aleko Konstantinov in the classic novel "Bay Ganio":

“What are you eating there, is it a pear? Well done! Let's see, since I'm lying down, can I eat a pear. Thanks! Where do you get these things?”

“We buy them!”, answers one of us, barely restrained.

“Really? Well done!”, he approves with his mouth full of juicy pear. "I like pears."

In the market economy, this brusqueness of folk psychology, combined with credit card and primitive advertising techniques, stimulate irrational consumer behaviour. Especially for those with fatally low financial culture, and in Bulgaria they are over 30% of the population.