By Kaloyan Zhelev

If we enter the website of the National Statistical institute in order to peek into the average annual index of the customer prices for the previous 12 months, for June for automobiles we will find an increase of just 3,1%. Similar check in Eurostat will show over five times higher the EU harmonized index, and the pace since the beginning of the year is growing.

Today, however, we are going to turn back to doubts regarding the representativeness of inflation statistics, and we will face a fact that is obvious to everyone: car prices have skyrocketed.

And if, according to various data from Europe and the USA, the growth in the average transaction prices of new cars is between 15 and 25, and in some cases up to 40% in the last year, then those of used cars have risen between 30 and 50%.

Expenses

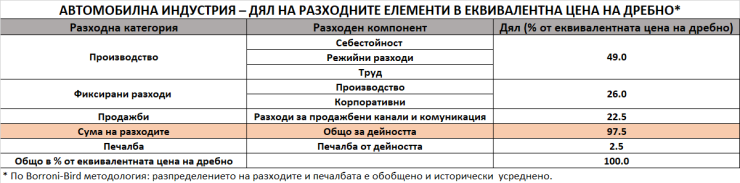

In order to understand the reasons, first we are going to look at costs in the automotive industry, deliberately simplifying an otherwise extremely complex process such as the production of a car.

And since due to the endless variables and complex interrelationships it is impossible to reduce things to a single final number, let's start with the fact that the production of the most complex product for mass individual consumption depends on the type of car, its content, the cost of energy, raw materials and components, as well as that of labor and research and development (R&D). And if the cost components themselves are much more and more complex, then they fall into two main categories - fixed and variable.

But before that, let's clarify the concept of profit. In a large and multinational business, profit is reported at different levels, some of which may be profitable, some of which may not. Automakers typically define profit at three levels: gross, operating, and net, so it's first and foremost important to be clear about which "level" of profit is being assessed.

First level in the issued accounting bills is ‘gross profit’ - the difference between sales revenue and production costs. Level 2 is "operating profit," which is gross profit minus normal operating expenses (overhead, rent, lease payments, and depreciation). The final level is "net profit", which is operating profit minus finance charges, tax payments, debt repayments and extraordinary items such as proceeds from the sale of assets. In most analyses, different businesses are compared by gross and operating profit, and because of differences in financial structure and taxation, net profit is primarily used for time comparisons within a business.

Thus the gross profit of the automobile manufacturers in recent years moves in corridor between 10% and 20% (historical averages are lower), with luxury brands at the top of the scale and mainstream brands at the bottom. Exceptions to the rule naturally exist.

Fixed expenses

Automotive manufacturing is a series of many interconnected processes, but at the beginning of all of them is research and development. Every time a new model is to be made, a series of research and development (R&D) and extensive tests are carried out. The implementation of these activities, as a rule, takes years and is associated with mandatory costs.

When calculating the cost of creating a car, you must consider the costs of maintaining facilities, creating and testing prototypes, finding suppliers, retraining workers, and adding new tools and technology. These costs do not change depending on the number of cars produced.

Variable expenses

Unlike fixed еьпенсес, variable costs depend on production volumes. In automotive manufacturing, the costs of raw materials, labor, and distribution can be classified as variable because they are directly related to production and change with its volume. If a car company wants to produce more cars, it will need to hire more labor; if he wants to reduce the volume, he will buy less raw materials.

Besides production volume, other factors also affect variable costs. Among them are the prices of energy carriers, so relevant to explain the trends at the moment.

Variable costs are the most significant component that automakers consider in their pricing; they are also most relevant in making economic decisions.

The major cost components in automotive manufacturing are research and development (R&D), raw materials, labor, and advertising. Raw materials account for about 47% of production, with steel accounting for almost 22% of the company's operating costs. The cost of materials and components depends on the region in which they are produced, the markets in which they are purchased and the volume of production.

Labour is the second biggest source of expenses for the automobile manufacturers. According to Statista, for example, the immediate labour represents 21% of the total expenses for car manufacture. Labour input also varies across car manufacturers, meaning different marginal costs.

It is usually paid on an hourly basis. In general, the time to make one car is about 17 - 18 hours. This, to be clear, is the time required to assemble the components, not the overall manufacturing process. Smaller cars can be assembled within 11 to 12 hours, while the manual processes of special cars such as Rolls-Royce can take months.

Research and development (R&D) is another major cost component in automotive manufacturing and accounts for about 6% of total manufacturing costs. Automakers also have to factor in administrative costs, which take up an additional 10%. Other costs, such as depreciation, logistics and advertising, accumulate to a total of about 16%.

Pricing

When determining the price of a car the automobile manufacturers have in mind different factors far from just manufacturing expenses. It is mandatory for them to make market analysis taking in mind similar models, customer interests and trends when buying as also a pile of other factors as for example are generational characteristics.

All this however is only basis economics. Roughly speaking, companies set their price so that it is not too high to discourage sales and not too low to balance their profit and operating costs. Among the exceptions are the ultra-expensive limited editions of premium manufacturers, where the demand mechanisms are set backwards.

Car emblems produce different models every year. They update their model range both to compete with their old models and because of their rivalry with other brands. If, for example, Volkswagen lowers the price of one of their models, say the Golf, there may be a negative shift in the demand curve for their other models, as some of the demand would prefer the Golf to other products.

Larger and more luxurious cars command higher prices due to their size and special features. As a model gets older, you will surely notice that its price starts to decrease. This reduction is the result of a decline in manufacturing costs with lower tooling and engineering costs over time. Subsequently, the price is reduced and to make the product more attractive, increasing/maintaining its sales volumes in line with the plans.

An increase in the production rate for a given period may also lead to a decrease in the cost of production. This can mean buying large quantities of raw materials and components at reduced prices, using automated machinery and using labor more efficiently. This reduction in unit production costs can lead to reductions in unit car prices.

More factors

Among the most significant pricing factors, as discussed, are the dynamics of supply and demand, as well as the action of contingencies such as climatic anomalies, epidemics and geopolitics.

It is their fortuitous combination in recent years that has caused the automotive industry to experience acute logistics and component shortages, starting with semiconductors, and with the superimposition of other factors (example: container imbalances, the emblem of which became the Ever Given stuck in the Suez Canal) were also added those of other primary raw materials and components, such as lithium, cobalt, plastics (the cold Texas February of 2021), structural wiring (Ukraine after February 24 this year), and many others.

Measures for social isolation of Covid-19 have both held back demand and created a new wave of interest in individual transport. The component deficit, on the other hand, caused a significant drop in capacity, which in 2021 drastically diverged between supply and recovering post-pandemic demand.

Lyrical digression: one often-overlooked factor driving up car prices is the unharmonized regional regulatory mish-mash. In Europe alone, car manufacturers comply with over 100 EU regulations and 80 directives covering the industry's activities. The example of the 77 regulations concerning the security of the United Nations Economic Commission for Europe, of which there are 50 in the European Union and another 40 in the Gulf Cooperation Council, suggests to what extent the final product of the automobile industry is made more expensive by the lack of regulatory harmonisation. As you notice, we haven't even brought up the subject of EU-mandated "green" electrification, which is forcing the entire industry to re-adjust its value-added and supply chain to adapt, and that means only one thing - a drastic increase in the price of the final product. To the extent that the executive director of Stellantis, Carlos Tavares, warned earlier this year that one of the main functions of the automotive industry was under threat, namely the provision of rights under Art. 13 of the Universal Declaration of Human Rights concerning freedom of movement.

All these processes forced a significant part of consumption to reorient to the secondary market, the stocks of which also quickly began to melt. To the point where new and slightly used car prices have leveled off and their new levels have delivered record profits despite falling production volumes and rising upstream and energy costs.

When

The big question, of course, is when the situation will become normal. The answer is not easy at all, mostly due to the simultaneous action of diverse factors moving in unidirectional vectors.

Even if the supplies of some components and raw materials are normalized, nothing guarantees the effect of similar factors on others; at this time, geopolitics is a constant source of instability, directly affecting energy and commodity prices, not to mention the supply chain.

And even if we assume that everything suddenly normalizes, it will take time to catch up with the accumulated demand and balance it with the supply. All kinds of deadlines are heard - from the end of 2023 to never, so the forecast of normalization is impossible due to the complex interaction of the listed factors, and today we did not even count them all.

Yes, vehicles are very expensive – I repeat the subtitle. And to the question when will the situation become normal I would rather bet on an answer in this spirit: to view the present as a new "normal", hoping for some medium-term decline, and to accept any other, more optimistic scenario as a very pleasant and unlikely surprise.