By Nikolai Vanyov

2021 offered us a lot of everything. We started it in a situation of lockdown and the second wave of the coronavirus pandemic, before witnessing the summer opening, the phase of optimism, which this time was quickly transferred not only to financial markets and macroeconomic environment, before the end of the year the Omicron strain surprised us - first with its virulence, then with the hopes that Covid-19 may finally become endemic.

Financial markets seemed to be moving in tune with these waves and news. The past year has left us with record high levels of most of the major indices measuring capital markets, but also at the crossroads on the main returns on government debt. It also left us with unprecedented levels of inflation from the global financial crisis in 2009 and many issues hidden beneath them, most of which concern not only investment and markets, but also global development in general.

On this background, what are the expectations for the markets in 2022 and what could be the investment strategies to optimize these expectations.

Inflation and monetary policies

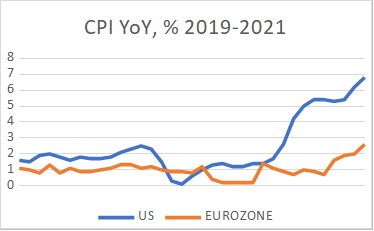

Undoubtedly, this is the topic of the past year, but it will continue to be the leading one this year as well. The latest data on rising consumer prices were at shocking levels of 6.2% in the US and "only" 2.43% for the euro area (where much more regulated prices are observed, for example electricity prices in Bulgaria, Greece, etc.). Although ECB President Christine Lagarde is reluctant to admit it, inflation is far from temporary. And this time on the west coast of the Atlantic, they seem far more adequate in their actions (at least as far as Jerome Powell at the head of the Fed acknowledged that part of the inflation may not be "temporary").

In fact, the phenomenon is changing the situation to such an extent that it even managed to accomplish one of the dreams of Lagarde's predecessor at the head of the ECB - Mario Draghi: pursuing more stimulating fiscal policies (for example business aid against high energy prices, which the EC does not have to consider as State aid).

Source: Bloomberg Professional

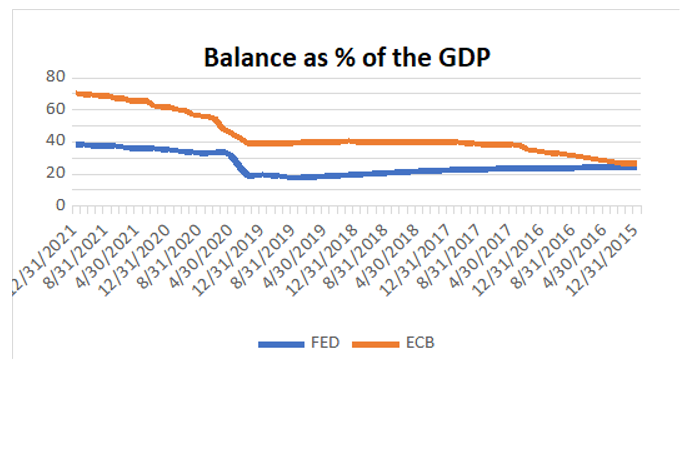

Source: Bloomberg Professional

No economist, or at least one with classical and fundamental views, can and will deny that the main factor in inflation is over-stimulating monetary policies, zero and negative interest rates and their "sweeping" of deep economic problems. The balance sheets of the main central banks are at record levels, and it will be crucial for the financial markets in 2022 how active the monetary institutions are in the fight against inflation. In fact, the focus may shift to how active central banks can be without imposing excessive systemic risks on financial systems.

Describing the main expectations for 2022, we must move on to the expectations for the financial markets for the year so that we can conclude with the strategies to apply to them. The mixture of increased inflation expectations, increased money supply and economic optimism lays the perfect foundation for growth in capital markets.

New peaks and records are more than expected, and it is possible that in the first quarter we will see the S&P 500 above the key level of 5,000 points, and the German DAX - over 17,000 points. Equities will definitely continue to be one of the most sought-after defenses against inflation, and economic optimism will continue to add fuel to their growth. Moving along the classical line of the theory of financial markets, if for cloud instruments a cloudless year is emerging, then for debt ones the storm seems certain. The state securities, especially these with the least credit risk (for example the German bunds) are a bad investment in years with high inflation expectations. The real yield on German securities at the beginning of January was below -2.50% for ten-year bonds, that on US Treasuries - below -4.5% (taking into account only the latest dimensions of inflation, regardless of expectations for the whole period). However, these instruments are key to the stability of the banking, pension, insurance and other systems, so given that they play a key role in liquidity-absorbing policies, high volatility is expected in their markets, but not projected growth of profitabilities (and declines in their prices).

In foreign exchange markets, the fundamental weakness of the euro was determined by the ECB's lack of room for maneuver. At the beginning of the year, the differences are only in interest rate expectations, but the materialization of real ones, especially against the US dollar, seems very likely in 2022 owning "colorful" money can be one of the most stable (but not profitable) investments.

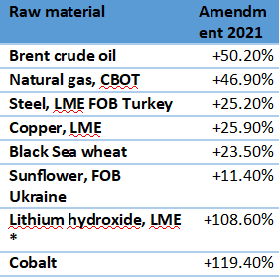

For basic raw materials, even the lowest growth rates for 2021 were over 50%. However, the end of the year and the beginning of 2022 turned out to be cooling times. Certainly, there is still room for cheaper energy, and the political perspective would be strongly directed in this direction. However, market distortions from phenomena such as the EU's green deal will certainly continue to play a role.

The situation is similar for metals, although economic optimism would continue to play a stimulating role in price growth. The food situation is hybrid - demand is certainly high at the beginning of the year, but it does not come entirely from the real (non-speculative) sector. The large amount of food raw materials in storage and the lack of free storage space could lead to fluctuations in supply, and hence in the prices of basic food raw materials. Expectations and effects of the green deal and global pressure to reduce carbon emissions are already materializing, with prices for materials such as lithium hydroxide and cobalt rising severalfold. Distortions along this line will almost certainly continue in 2022.

Source: Bloomberg Professional

* The change is only for the second half of 2021.

As for the Bulgarian financial markets, it seems that in 2022 it will be cloudless for the shares of the BSE. The past 2021 was the year of listings through the BEAM platform, and investors, most of whom were individual, i.e. with little or no experience, acting more like venture capitalists in pursuit of the coveted unicorn. Maybe 2022 will be a year in which the focus will shift from startups to real, settled businesses, where investor protections are a little more fundamental.

As for the debt market, the clouds there look dark. The global increase in profitability does not exceed the Bulgarian government securities, while the government's offer to finance the planned deficits will be high, which is the basis for serious volatility in government debt prices.

Against this background, what could be the main investment strategies?

Since the volatility of financial markets seems to be leading, along with uncertainty, but also economic optimism, I think the strategy for 2022 should be called "Hedge+" - i.e., investors will seek to avoid systematic volatility at the expense of the idiosyncratic risks from which to find profitability.

In the field of companies, my philosophy is always to avoid non-business risks. In view of high inflation and rising expectations, interest rate hedging, especially for companies with high floating interest rates, seems mandatory. Interest rate swaps and options seem like good options for this. Currency volatility, whether in revenue or expenditure, should also be avoided. Commodity hedging also seems to be a good strategy when companies depend on the supply of raw materials (the transfer of costs to end users is always lagging behind, and this has a negative impact on the margins and results of manufacturing companies).

In the prism of individual investors, it is good to take a holistic approach to investment strategy. Each of us' portfolio includes not only investments in financial instruments, but also our personal capital, real estate, liabilities, etc. In this sense, interest rate hedging seems to be a good option, despite the barrier of high nominal interest rate swaps and options, this can still be achieved through various other instruments (for example short-term government futures). Compliance with the rules of diversification (including human capital related to the profession and sources of income) is also key for each individual investor. Investments in equities should be sufficient to hedge inflationary pressures in well-diversified personal portfolios, and we must not forget that owning a home or other real estate is also an investment that will provide good protection against inflation for the entire wallet of an individual.

THE BOTTOM LINE The 2022 strategy should be called Hedge+ - i.e., investors will seek to avoid systematic volatility at the expense of idiosyncratic risks from which to find a return.