By Preslav Raykov

Аs we are living in a petroleum era, it is hard to imagine that there is anything more central to modern civilization than black gold. But it turns out there is!

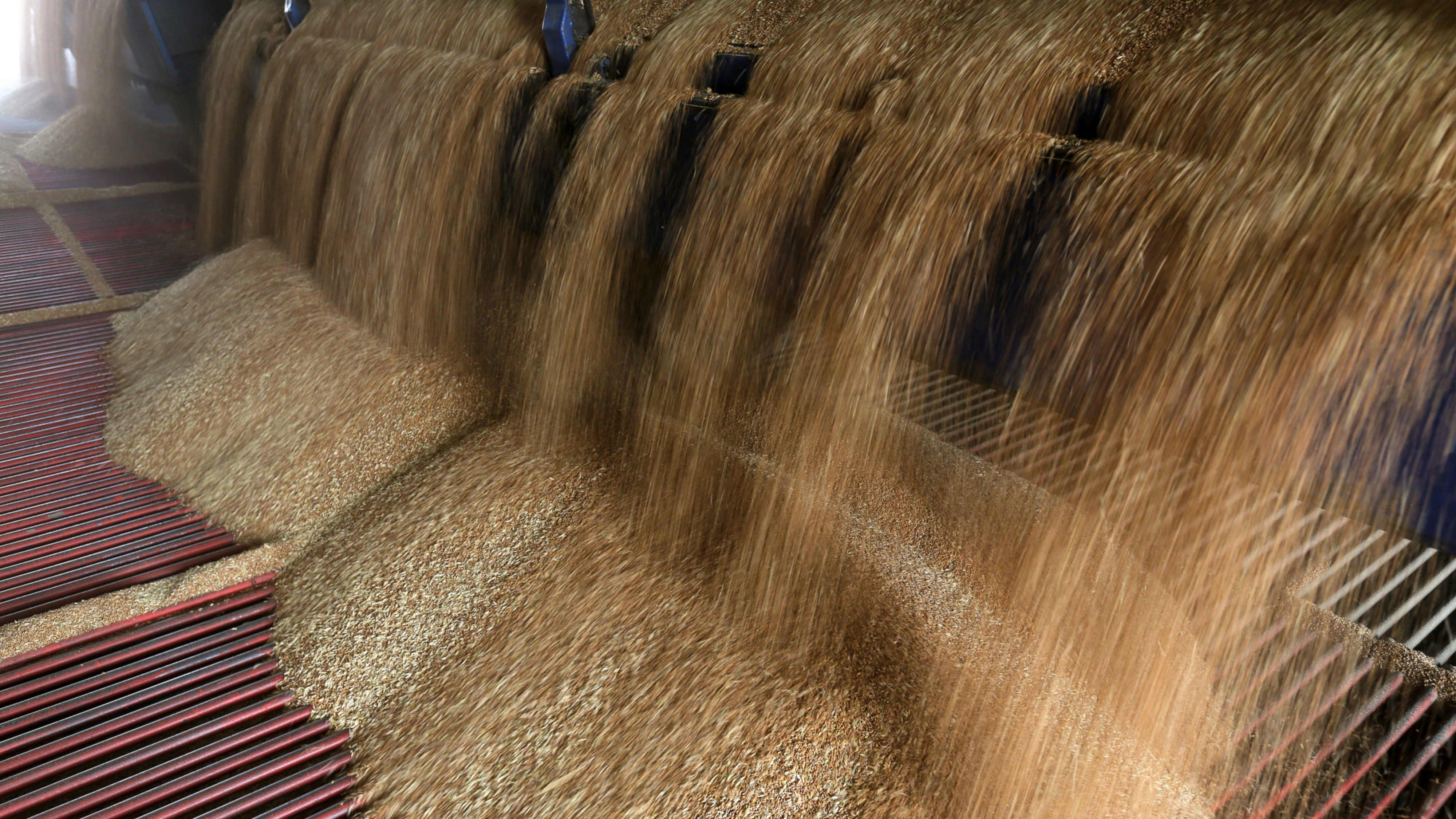

Cereals are a major part of our lives, even without realizing it directly. If globally the main benchmarks of the economy are oil from the two Brent and West Texas blends, then in the grain markets, the main crops for human consumption are corn and wheat. Almost everything that modern man uses and consumes, in one way or another, is related to the most ancient food raw materials known to mankind.

Let's take just one example: of the approximately 44,000 items in the average American supermarket, more than 50% contain corn subproducts. In their daily lives, modern people invariably use products originating from the grain markets - corn, wheat, soy, rice, barley.

The nutritional uses of the grain are well known, but there are some that we did not expect. And they have a strong impact on our lives and the global rise in prices over the last year. As you fly on an airplane running on fuel mixed with a biocomponent of soy or corn, read this article in a magazine whose paper is made by adding wheat starch to increase resilience and sustainability, you begin to realize that the application of grain in modern life is far greater than croissants and toast for breakfast.

From morning to night, our day turns into a covert collaboration with grain markets without us even realizing it: beginning from early morning with the toothpaste containing cornstarch to lunch spaghetti made from wheat, appetizing beef, chicken and fish for dinner fed mainly on soybeans or corn. When we travel to and from work by bus, car and even a plane, we hardly think that they are moving thanks to fuel with biocomponents, produced mainly from corn, rapeseed and soybeans. And winter car tires contain sunflower oil added to the raw material for their production in order to increase the elasticity of rubber. Even the aspirin tablet we take for headaches cannot be produced without grain derivatives and modern plant starch applications in the pharmaceutical industry. After the World War II, grain markets became an instrument of geopolitics and influence, and their applications in modern life expanded exponentially.

Today, two years after the beginning of the Covid pandemic and in the midst of a heated military conflict in Europe, the grain reminds us of its important place in our lives.

Cereal diplomacy

According to the Food and Agriculture Organization of the United Nations, there is enough food in the world to feed humanity for the next 30 years - even if the global population reaches 10 billion people. But practice shows that despite impressive statistics from the era of globalization, from 1991 to 2016, more than 815 million people (11% of the world's population) still suffer from chronic malnutrition. Cereals worldwide provide more than 80% of humanity's caloric intake, are suitable for storage and can be transported relatively easily around the world. This makes them extremely attractive to a large group of companies that ensure their movement along the supply chain to end consumers.

Since ancient times, grain shortages in some regions of the world and surpluses in others have led to the creation of one of the most ancient raw materials markets. Today, grain trade is concentrated in several global conglomerates that control markets and move large quantities of grain. Some of them, such as China's COFCO International, are an instrument in the hands of the Chinese government, which ensures that the country's population will be provided with raw materials and food. China's grain diplomacy has been extremely active for the past 10 years, and the country is increasingly using its purchasing power to buy grain from around the world. And when the Chinese buy, the markets react dynamically, and everyone takes that into account.

Although in normal times the grain trade was considered a relatively boring market, in recent years grain markets have become an important tool for geopolitical influence. After an extremely volatile two years caused by the global Covid pandemic, the world has faced a record rise in commodity prices. And the military conflict between Ukraine and Russia implies an additional rise in prices for almost all key raw materials. Such a development puts the world under inflationary and therefore social pressure and dooms entire societies to extreme poverty, deteriorating living standards, or even malnutrition, civil disturbances and wars.

In a world with a growing global population but declining globalization and increasingly fragmented societies and markets, agricultural resources will continue to be transformed into increasingly powerful geopolitical instruments of influence. In the context of the pandemic that has put the world to the test in the last two years, as well as the ongoing global military conflict, feeding the population in a sustainable and stable way will become a key issue. These attitudes will also determine the development of future markets on which we depend for much of the agricultural raw materials we consume. The most logical forecast shows that in the future grain markets will be formed not on the basis of integration, but on competition between rival countries.

Farmers, central bankers and wheat shortages

Globally, the white soft wheat harvest has been severely affected by adverse weather conditions during the last agricultural season, further tightening expectations of market shortages over the next six months. The United States recorded the lowest levels in its wheat exports for the last 6 years. The latest Department of Agriculture report for February found that 71% of the winter wheat harvest was severely affected by drought in late 2021 and early 2022. In addition, the US share of world wheat markets has declined significantly over the past 15 years at the expense of increased supply from the EU and Russia. In comparison, between 2001 and 2005, US wheat exports accounted for 25% of the world market, compared to approximately 13% last season.

China also reported unfavorable developments in its harvest, caused by heavy rainfall and the inability to sow the necessary quantities at the end of 2021. The Ministry of Agriculture clarifies that the winter harvest may be one of the worst in the country's history. In view of China's growing consumption in recent years, the country has begun to actively seek ways to provide the quantities needed for food security and to avoid social tensions from rising food prices.

The situation in Canada is also worrying. The country is one of the main producers and exporters of wheat, with the authorities reporting very bad consequences from the drought that was observed during the development of the winter harvest. But drought and an unfavorable global climate are just some of the problems that are holding back global wheat supply. Farmers continue to face severely disrupted supply chains, high prices and shortages of fertilizers, as well as deadly stock market volatility caused by Covid and ongoing military conflict. In addition, world wheat stocks are expected to shrink to their lowest levels in the last 3 years.

All this predetermines a possible severe shortage of wheat worldwide in the upcoming months if a quick and effective solution to the military conflict in Ukraine is not found and exports from the Black Sea region are not restored. The expected drastic price movements will increase the price of a number of end-use foodstuffs, which will drive additional inflationary pressures and influence the decisions of central bankers to raise interest rates faster and on a larger scale and withdraw quantitative easing. This fact could block the world economy in a situation of stagflation and stop the expected recovery of the economies at the end of the pandemic.

Black Sea tension

The escalating military tension between Russia and Ukraine is having a very negative effect on global grain markets – and not just energy. Extreme volatility and instability have pushed the prices of major agricultural commodities to record highs. Although the main focus at the moment is on the possible disruption of gas supplies through Ukraine towards Europe, as well as oil production in Russia, the role of Ukraine and Russia in global grain and food supply chains at this stage still remains out of sight of the international community.

Ukraine has been known as the "granary" of Europe since Soviet times, the country is one of the main producers of grain for Europe. Today, Ukraine is Europe's fourth largest supplier of food, supplying almost 50% of the EU's corn. However, we still do not see backup plans and preparations by Brussels for the inevitable shortage of supplies from Ukraine, although grain markets have reacted soberly to what is happening in the country. Wheat futures on the stock exchanges in the US and Europe registered growth of over 80% in March - respectively, the corn on the stock exchanges in Chicago and Paris rose by up to 50%. This will undoubtedly put many European consumers under strong pressure from the trend of constantly rising food prices.

Ukraine and Russia are very important world markets for grain. Together, the two nations account for 30% of world wheat exports, and the Black Sea basin serves as a major channel for international grain shipments, providing key quantities for world markets that balance global production, which has been tight this season. Ukraine is the fifth largest exporter of wheat, accounting for just over 10% of the world's quantities, and ranks fourth in corn exports. For the current season the country managed to register the largest corn harvest of almost 43 million tons. The country exports over 80% of the produced quantities of corn to world markets and thus balances world reserves extremely well. The conflict also coincides with the country's most active corn export season, with blockages in Black Sea ports and disrupted transport infrastructure further hampering exports and putting the world balance at risk of severe shortages and astronomical prices. According to many forecasts, the production and export of corn from Ukraine next season is expected to decline by more than 35%, further tightening world markets. Potentially serious consequences for food security could also come from disruptions in wheat supplies from Russia. The country is the largest exporter of wheat worldwide, producing 10% of world quantities and providing 20% of international exports.

Potential for a new Arab Spring

Europe is able to easily deal with disrupted supplies from Ukraine thanks to a well-developed grain market, but the countries of the Middle East, North Africa and Asia depend heavily on Ukrainian grain exports. The countries of the region are the largest consumers of wheat in the world, but are extremely dependent on imports due to their dry climate and water shortages. At present, food prices in the region are at a highest record in 10 years, precisely because of their dependence on grain imports from Russia and Ukraine, especially countries such as Egypt. The country is the world's largest importer of wheat, covering 60% of its needs from Russia and the remaining 30% from Ukraine. The Egyptian food crisis may be exacerbated by the fact that the main caloric intake of Egyptians comes mainly from the heavily subsidized food sectors, which use mainly wheat and sunflower oil. The country's budget is under extreme pressure, with international financial markets seeing even financial risk for the country, as evidenced by Egypt's sharp rise in its insolvency insurance premium (CDS) over the past month. Since the beginning of 2021, the Cairo authorities have been under severe pressure from galloping food inflation, which has been at its highest level since the Arab Spring and risks new social tensions, similar to 2012, when the country was rocked by civil unrest led to the overthrow of the government of Hosni Mubarak.

Currently, the situation is similar to that in 2012, and the fragile recovery of the Egyptian economy over the past 10 years is again at risk. A jump in grain prices of more than 70% puts enormous pressure on the budget, but the greater danger is that Egypt faces the risk of not being able to provide enough grain to feed its 105 million people because of the war in Ukraine. Over 85% of grain imports in the country are provided by the Black Sea region, which is currently almost completely blocked.

Egypt currently has reserves available for about four months, but the authorities need to be prepared for swift and timely measures to diversify supplies because the Egyptian economy is unable to produce even 50% of the required grain and vegetable oils. At the end of February, Cairo canceled the wheat auction due to the fact that no offers were received from either Ukraine or Russia. Alternative supplies from France, Romania and Bulgaria are now being sought, as well as imports from the United States and Canada.

The situation in Turkey is similar: the country imports just over 23% of its wheat from Ukraine, and almost 65% from Russia. This fact makes the country extremely dependent on production in the region, and the Turkish economy is still under severe financial stress due to the collapse of the Turkish lira and President Erdogan's unconventional monetary policy.

The conflict between Russia and Ukraine will greatly aggravate the situation by providing enough grain in Lebanon as well. The country provides 35% of its caloric intake based on wheat, which mainly comes from Ukraine, Russia and the Black Sea region, including Bulgaria and Romania. Ukraine is the second main importer of bread wheat in Lebanon, after Turkey, which holds the first place. In general, in the countries of the North African and Middle Eastern region, rising wheat and corn prices could lead to very severe social tensions, protests and attempts to overthrow governments. The state budgets of many of these countries have been hit hard by the pandemic, and each new shock has the potential to upset the delicate balance of political peace in the region. This was one of the factors behind the start of the Arab Spring and the great wave of refugees that followed the unrest in the region.

Resource protectionism in Europe

Europe is a net exporter of food, with Ukraine, despite being the fourth largest importer of agricultural goods, accounting for only 4.9% of total grain imports in Europe. However, specific grain crops are highly dependent on imports from Ukraine, with 88% of sunflower oil in Europe and 41% of rapeseed imported from Ukraine. The same is true for corn, which is mainly used for animal feed production, and possible supply disruptions could affect pork and chicken production in Europe and increase prices dramatically in the coming months.

Undoubtedly, the military conflict will intensify the growing wave of resource protectionism that began in the last two years in response to the pandemic. A fact that has been extremely strong in Europe for the last 2 years is the increased food protectionism. Driven by uncertainty over the past two years, many European countries have imposed temporary restrictions on grain exports or quotas for fears that markets will be severely deficient and lead to social tensions and food shortages.

The latest such cases are from Romania, Hungary and Bulgaria, which are also countries that are major producers and exporters of grain to global and regional markets. Such waves were observed in all three countries, with Bulgaria holding a state tender immediately after the start of the conflict in Ukraine to buy the quantities needed for the country and imposing a temporary ban on Romania's exports of agricultural goods during the worst months from the Covid pandemic, which created extreme tension among producers in the country.

THE BOTTOM LINE In a world with a growing global population but declining globalization and increasingly fragmented societies and markets, agricultural resources will continue to be transformed into increasingly powerful geopolitical instruments of influence. - Preslav Raykov