By Petko Truhchev

The European Union has become a pioneer with its carbon neutrality programs. The request of the Old Continent is to be the first with zero emissions by 2050. This means a total abandonment of polluting energy sources, mainly coal and oil. Brussels intends to replace them with hydrogen in the energy and transport sectors. And while discussions on the issue have been going on for several years, and for a whole year the EU has not yet been able to decide which energy sources to include in the taxonomy (financing green energy projects), China has said it will dominate hydrogen energy.

Beijing's goal is for the country to represent more than 60% of global electrolysis plants worldwide as early as next year. If that happens, China will once again be ahead of the EU in implementing green energy sources, just as it has quietly managed to become a leader in solar energy. In terms of the share of consumption of 6.2% per capita is leader in the indicator. It is again the first in terms of capacity, as in 2020 the produced solar energy is 254,355 MW or more than 100,000 more than the EU.

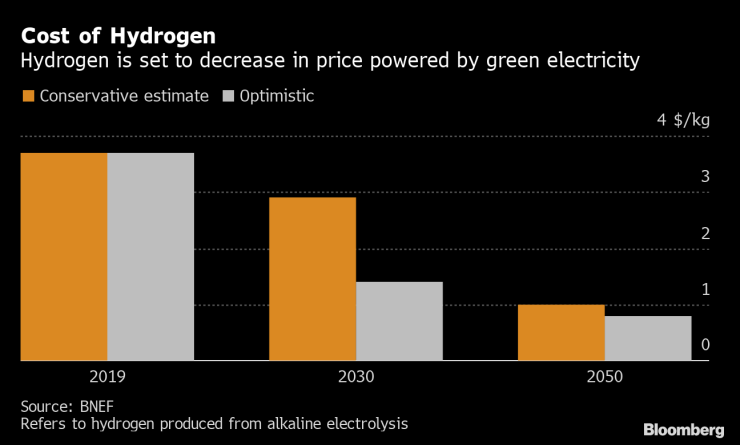

The greatest hopes are placed on technology based on electrolysis. The mass entry of hydrogen into industry and household will depend on its price. So far, it is high, and rising electricity prices currently do not suggest falling in price. As a secondary raw material, hydrogen is produced by electricity, which feeds the physicochemical reaction of the process. Its final price will be directly affected by electricity prices. At over $ 4.5 per kg at the moment, to become widely available, it must reach $ 1/kg at an electricity price of $ 10 / MWh. Such a price can be reached only by 2050, according to the calculations of the consulting company Bio energy International. Their Wood Mackenzie counterparts are more optimistic, estimating that a kilogram of hydrogen could cost $ 1 as early as 2030. The price is conditional and will depend on the country and the specifics of electricity and hydrogen production. Both forecasts are made only for the price of green hydrogen, for the production of which all green energy is used. The stated goals of each country are unattainable without political determination for the introduction of new technologies in the production of raw materials.

Here comes the role of China, which relies on electrolysis plants to lead the world hydrogen race. Beijing's strategy is based on that of dominating solar energy - reducing production costs, drastically increasing installations and accelerating the development of new technologies. So far, however, the Chinese government has not provided significant incentives for the "hydrogen economy" in contrast to strong support for green energy. And if the state supports the production of hydrogen technologies, then by 2030 the situation with photovoltaics will be repeated, where 1.6 solar panels in the world are made in China.

However, in order to achieve a low price of hydrogen, as it turned out, the price of electricity is of key importance. It is the main cost component in the production of hydrogen by electrolysis. The other determining costs are the capital costs for the electrolysis installation (alkaline, polymer, etc.). Costs such as labor, land and water are an insignificant factor in the production costs of hydrogen.

With the mass entry of hydrogen into the markets, there will be a need for its trade. It is not currently traded as a commodity, like oil and gas. Hydrogen sales today are limited due to low production volumes and lack of adequate transmission infrastructure. The challenge, apart from mass production, is to build a transmission infrastructure to reach the end user.

The cheapest way to transit hydrogen is through gas pipelines. The EU plans to build the newly built gas pipelines in such a way that they are compatible for hydrogen transmission. This will reduce infrastructure costs. Local distribution is now possible through tanks. And mass infrastructure through pipelines is proving to be an expensive undertaking and the capital costs for it will be high. In addition, they are not reported in production. The minimum cost of a new underwater hydrogen pipeline is estimated at $ 4.7 million per kilometer, according to Statista, a market-based database. And upgrading existing pipelines on land costs about $ 150,000 an average price per kilometer.

Gas for Climate estimates that 40,000 km of pipelines are needed to transport hydrogen to the EU in 21 member states. Assuming that even if all 40,000 km pipelines are available and can be upgraded to carry at least € 8 billion to transport hydrogen. The amount does not seem prohibitive against the backdrop of the colossal funds earmarked for the EU's energy transformation. However, the construction period is less than 10 years, and currently there are no major projects in this direction.

For countries in Central and Eastern Europe, infrastructure can be a problem. On the one hand, because of the underdeveloped gas transmission networks. On the other hand, because of the still high levels of corruption, which make the construction of new interconnections more expensive and slow. These amounts do not include the obligatory compressor stations, without which not every single pipeline can do. Especially for hydrogen, as it is highly flammable and more dangerous than natural gas, it is imperative to ensure the safe operation of future facilities. Although gas pipeline accidents in Europe are significantly lower than in the United States and India, the last major accident in Belgium in 2004 was marked by 24 victims and more than 150 people with severe burns.

THE BOTTOM LINE Beijing's goal is for the country to represent more than 60% of global electrolysis plants worldwide next year.

The EU is also lagging behind in the EU's second-largest carbon sector. In the future, it relies on hydrogen to replace conventional engines. However, major European carmakers still do not have a market series for hydrogen-powered cars. In 2017, German carmaker Daimler turned its back on its hydrogen car project and focused on electric cars. BMW borrows Toyota's technology for a hydrogen car. Asians are pioneers in this regard. Limited series in markets in North America, Europe, the Middle East and Australia are available on Toyota, Hyundai and Honda. Along with the fleet, the charging infrastructure will be modernized. There are still very few hydrogen stations in Europe.

The prospects for the hydrogen trade do not seem so complicated. Mass production of secondary raw materials seems to be the easiest to do. Pressure to meet climate goals will increase demand in the future, especially from energy-intensive industries such as metallurgy. These two factors will lead to lower prices. Its future is unclear when it comes to the price of electricity produced from renewable sources. If the implementation of the green economy plans is delayed, green hydrogen production will also lag behind. The low cost of green energy is of primary importance. In turbulent times, such as the one in the second half of 2021 in the EU energy markets, the most important factor for green hydrogen production - clean energy at an affordable price - will not be secured. Therefore, until the predominant green share of energy in the EU is reached, which will happen through the opening of more renewable energy plants, mass production of hydrogen is unlikely to happen. The next step, involving the transmission infrastructure, involves accelerating the construction or modernization of pipelines so that they are transit and hydrogen transit.

Pipeline transmission will significantly reduce its cost due to its proven low cost and fast transit. Tank transport will make the final price more expensive, and the endeavor is pointless unless hydrogen engines are used instead of conventional diesels. Less than a decade remains until 2030, so Brussels must pay attention to transmission infrastructure, which is currently not on the agenda. And if in this sense, European officials put the cart in front of the horse, the competing energy supplier from Russia began a year ago to add the possibility of transit of hydrogen through the existing gas pipelines to nearby Europe and Asia.